Major Differences Between Saving And Investing

Major Differences Between Saving And Investing

Financial literacy is essential because it teaches you how to achieve your goals, regardless of those financial goals. When you manage your money with knowledge, you can make the best decisions for your present and your future. in this article we will let you know differences between saving and investing.

Financial institutions work to help you develop best practices and develop more robust strategies that will define a part of your life. These three differences between saving and investing are important to know if you want to grow your wealth.

Table of Contents

Save wisely

Saving money for emergencies or as a fund for specific situations allows you to have full control of your money when you need it. A savings account will enable you to add, withdraw and store cash while keeping it safe with a financial institution.

Managing your savings allows you to do many things, and this balance will remain stable if you don’t withdraw too often. Savings accounts are ideal for achieving goals like buying a home or car, traveling, or making significant purchases. These accounts can sometimes generate money, but these monthly earnings are small.

Investing Your Money

You can invest your money in various ways, from buying land, which can double in price, to investing in the stock market. Any investment risks losing money, but these financial opportunities also allow you to earn more without much work.

Investing is one of the best ways to grow your money effortlessly. You can invest some of the money you save right now, whether from your employment or a retirement account. For example, if you qualify for retirement, you need to know how to do a self-directed IRA rollover to invest the money you’ve saved and generate more income.

Importance of Both

Saving is a short-term measure you can take to build a solid fund. Investment opportunities begin with savings, and these investments are often long-term processes that can have multiple outcomes, but the rewards can be well worth it. The main difference between saving and investing is choosing what is best for you between your lifestyle, goals, and reality.

How are saving and investing similar?

Saving and investing have many different characteristics, but they share a common goal: they are two strategies that will help you accumulate money.

Both use specialized accounts with a financial institution to accumulate funds. For savers, this means opening an account at a bank like Citibank or a credit union. For investors, this means opening an account with an independent broker, although many banks now also have a brokerage branch. The most popular online investment brokers are Charles Schwab, Fidelity and TD Ameritrade.

Savers and investors also know how important it is to save money. Investors should have enough funds in a bank account to cover emergencies and other unforeseen expenses before committing much of the change to long-term investments.

As Hogan explains, investing is money you want to leave alone “to let it grow for your dreams and your future.”

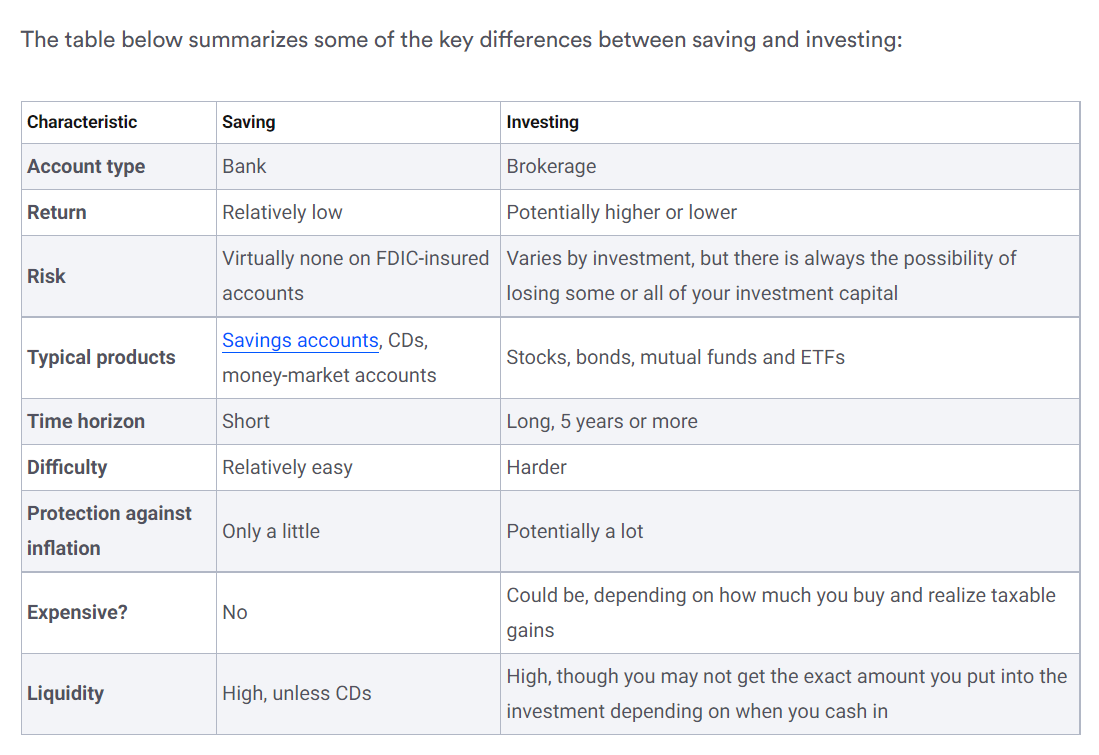

How are saving and investing differently?

Although the two endeavors share similarities, saving and investing differ in many ways. And it starts with the type of assets in each account.

When you think of saving, you think of banking products like savings accounts, money markets, and CDs or certificates of deposit. And when you think of investing, you think of stocks, ETFs, bonds, and mutual funds, says Keady.

The pros and cons of saving

There are many reasons why you should save your hard-earned money. For one thing, it’s usually your safest bet and the best way to avoid losing money. It’s that easy, and you can quickly access funds when needed.

Overall, the savings come with these benefits:

Savings accounts tell you in advance how much interest you will earn on your balance.

The Federal Deposit Insurance Corporation guarantees bank accounts up to $250,000, so you won’t lose money using a savings account, even if the returns will be lower.

Banking products are usually very liquid, meaning you’ll get your money when you need it, although you may have to pay the penalty if you try to access a CD before the due date.

There are minimal fees. The administrative fee, or fee for violation of Regulation D (when more than six transactions are done from a savings account in a month), is the only way for savings account with a bank insured by the FDIC to lose value.

Saving is usually simple and easy to do. There is usually no upfront cost and no learning curve.

Despite its advantages, savings have some disadvantages, including:

The returns are low, which means you could earn more by investing (but there is no guarantee).

Since the yields are low, you may lose purchasing power over time as inflation eats away at your money.

The pros and cons of investing

Saving is definitely safer than investing, although it probably won’t result in the most significant wealth accumulated over the long term.

Here are some of the benefits of investing your money:

Investment products like stocks can have much higher returns than savings accounts and CDs. Over time, the Standard & Poor’s 500 (S&P 500) stock index has returned about 10% per year, although returns can vary significantly from year to year.

Investment products are generally very liquid. Stocks, bonds and ETFs can be easily converted to cash almost any day of the week.

With a broadly diversified stock collection, you can easily beat inflation for long periods and increase your purchasing power. Currently, the target inflation rate used by the Federal Reserve is 2%, but it was much higher over the past year. If your returns are below the inflation rate, you will lose purchasing power over time.

While there is potential for higher returns, investing has many downsides, including:

Returns are not guaranteed, and there is a good chance you will lose money, at least in the short term, as the value of your assets fluctuates.

Depending on the timing of the sale and general economic conditions, you may not get back what you originally invested.

You should keep your money in an investment account for at least five years to avoid short-term downturns. You generally want to keep your investments for as long as possible, which means not accessing them.

Because investing can be complex, unless you have the time and skills to learn how to do it, you will likely need expert help.

Broker account fees may be higher. You may have to pay to trade a stock or fund, although many brokers offer free trades these days. And you may have to pay an expert to manage your money.

Summary:

Saving is frequently done for immediate aims, whereas investing is done for long-term ones.

Savings only go into a bank account, but you may invest in various things, including stocks, real estate, and fine art.

Investing might double or quadruple your money, while saving provides little to no financial return.

Your objectives, needs, and options will determine how to use your money. Anyone attempting to achieve financial goals will find that budgeting is an essential tool.

Also read: Download HD Desiremovies

Also read: LMAO Meaning